Create OFTTC Tax Credit Application

Create an OFTTC Tax Credit Application:

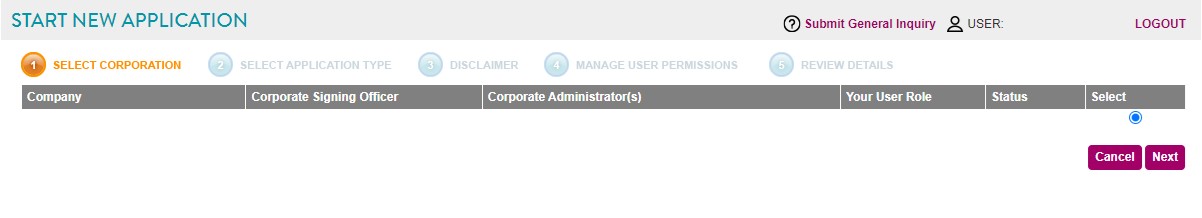

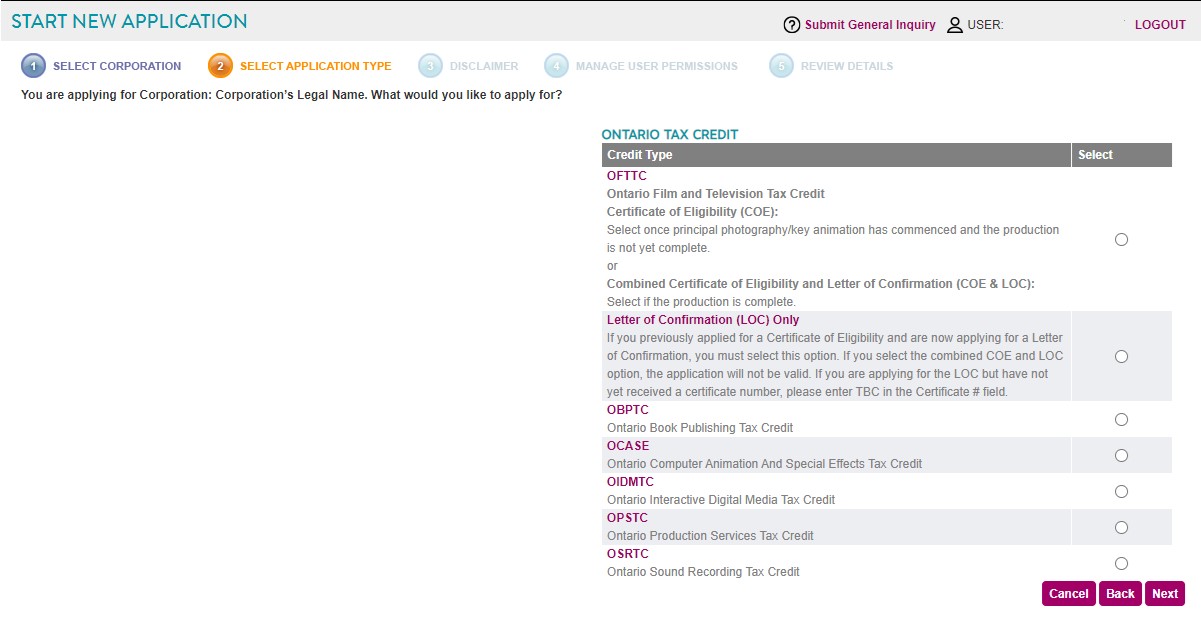

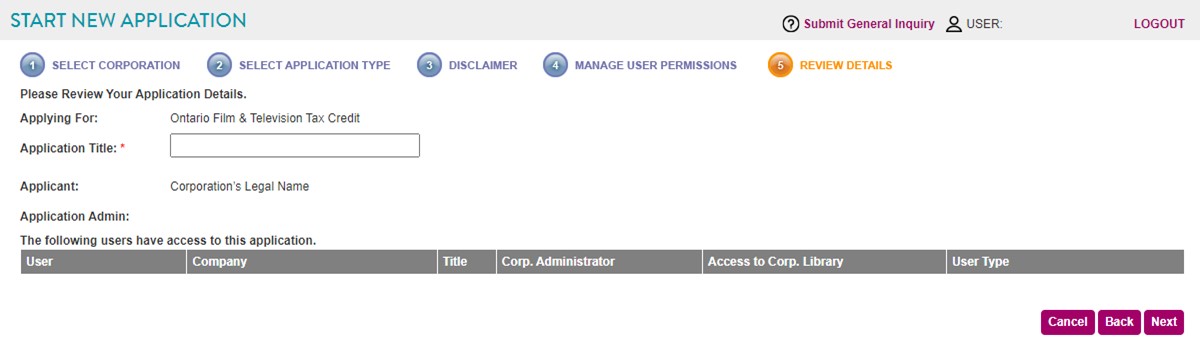

The Applications page will display as shown below.

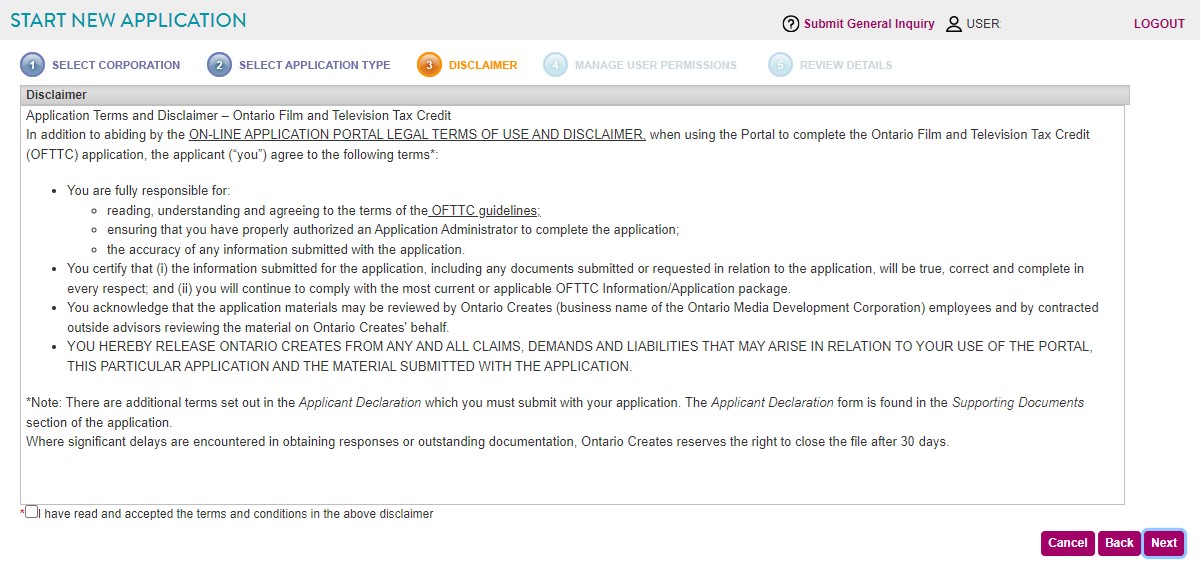

The Disclaimer page will display.

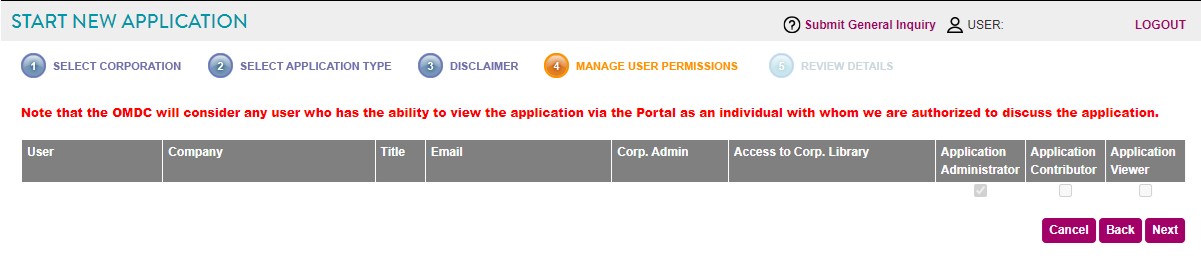

The Manage Users Permission page will display.

Filling out the General, Production Details, Production, Post Production and Distribution, Producers and Key Creative Personnel, Calculation of OFTTC Estimate, Administration Fee and Supporting Documents Sections:

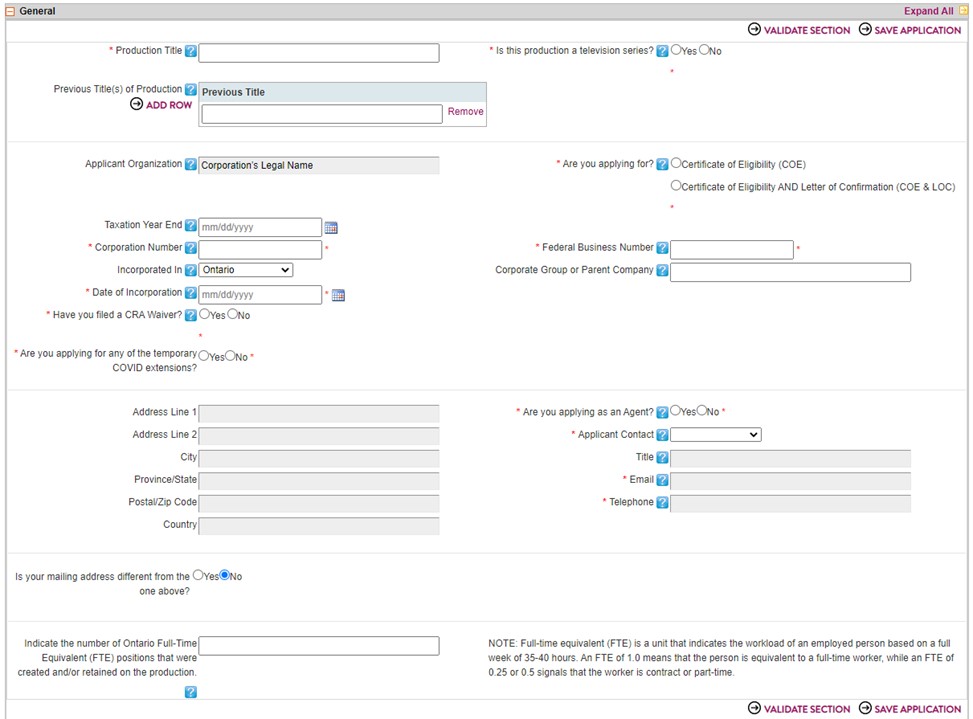

Filling out the General section:

To use the Calendar function, click on the icon. The calendar will display as shown below.

Click the right or left arrow keys shown above to scroll through the months or click directly on a day to populate that day.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY Tax Credit Form, click the button to ensure you have filled that portion of the form out correctly. If the validation is okay, the header will change to green.

Note: By clicking on the Validate Section button the section will NOT be saved but only validated the content is correctly/incorrectly filled in.

If you are unclear about a certain field, click the icon, this will take you to the specific section of the Online Help File where a definition for that field will display.

Definitions for the General Section:

Production Title - Enter the name of the production.

Is this production a television series? - A television series consists of more than one episode.

Previous Title(s) of Production - Please list any previous working title(s) for this production.

Applicant Organization/Qualifying Corporation - This is the corporation�s legal name as entered in the Corporate Profile. If you would like to make changes to this field, please return to the Corporate Profile.

Are you applying for: If the production is complete and has final costs select Certificate of Eligibility AND Letter of Confirmation. If the production is not at this stage then select Certificate of Eligibility.

Ontario Corporate Tax Account Number - The Ontario Corporate Tax Account Number is issued by the Province for companies filing tax returns for fiscal years ending before January 1, 2009. This number is being replaced by the Federal Business Number for fiscal years ending in 2009 and beyond.

Fiscal Year End - Enter the date of your company�s first fiscal year end after the start of principal photography (PP) for the production. If you have not filed a corporate tax return yet, please enter the anticipated date of the first year end after PP. Please note the deadlines for application are calculated based on the fiscal year end of the production company. The onus is on the production company to inform OMDC of any change in, or final determination of, >>--> >>-->the fiscal year end at the time such change in, or determination of, the fiscal year end occurs . OMDC will not be responsible for any failure of the production company to comply with this requirement. Please be aware that an incorrect fiscal year end may adversely affect the calculation of these deadlines for the production company.

Corporation Number - The Corporation Number is different from the Ontario Corporate Tax Account Number. This is the number on the Articles of Incorporation.

Federal Business Number - The Federal Business Number is replacing the Ontario Corporate Tax Account Number for fiscal years ending in 2009 and beyond.

Incorporated In - This is the jurisdiction where the company is incorporated.

Corporate Group or Parent Company - If the applicant corporation is controlled or owned by a corporate group or parent company, enter the name here.

Have you obtained a CRA Waiver? - CRA Waiver in Respect of the Normal Reassessment Period (CRA Form T2029) The applications for both a Certificate of Eligibility and a Letter of Confirmation must be submitted to the OMDC no later than 24 months from the production company�s first taxation year end following the commencement of principal photography. If this application deadline cannot be met, it may be extended to 42 months from the first taxation year end date where the production company has filed a valid Waiver in Respect of the Normal Reassessment Period with the Canada Revenue Agency (CRA Form T2029 available on CRA�s website at www.cra-arc.gc.ca). >>--> >>-->

The deadline for applications is calculated based on the fiscal year end of the production company. The onus is on the production company to inform OMDC of any change in, or final determination of, the fiscal year end at the time such change in, or determination of, the fiscal year end occurs . OMDC will not be responsible for any failure of the production company to comply with this requirement. Please be aware that an incorrect fiscal year end may adversely affect the calculation of these deadlines for the production company.

Is the production an international co-production?

Canadian Portion of Copyright (%)

Are you applying as an Agent? - An agent applies for a tax credit on behalf of the applicant corporation with the applicant�s consent.

Contact - Please select the primary contact from the dropdown list. To add another name, please have the application administrator grant the appropriate permission.

Title - This is the contact�s title. It can be changed in the User Profile.

Email - This is the contact�s email. It can be changed in the User Profile.

Telephone - This is the contact�s telephone. It can be changed in the User Profile.

Fax - This is the contact�s fax. It can be changed in the User Profile.

Indicate the number of Ontario Full-Time Equivalent (FTE) positions that were created and/or retained on the production - The Ministry of Tourism, Culture and Sport has requested that OMDC collect this data to understand the impact of support to these sectors.

Cycle - Select the season number from the dropdown menu. Enter the episode numbers for the season.

Total Cost of Production - This is the total of Canadian and international cost.

Total Cost of Production This is the total of Canadian and international cost.

Total Canadian Cost of Production - Consolidated cost among Canadian jurisdictions.

Total Ontario Location Shoot Days - Ontario Location Shoot day refers to a day on which principal photography for the production is done outside a film studio in Ontario.

Ontario Location Shoot Days Outside the GTA - Greater Toronto Area (GTA) means the geographic area composed of the City of Toronto and the regional municipalities of Durham, Halton, Peel and York.

Total Ontario Studio Days - Studio days refers to filming in a building in which sets are used for the purposes of making film or television productions and sound, light and human access are controlled.

Ontario Studio Days Outside the GTA - Greater Toronto Area (GTA) means the geographic area composed of the City of Toronto and the regional municipalities of Durham, Halton, Peel and York.

Locations Where Functions Performed - Points are allotted if location is Canada.

Person/Location Where Function Performed - Points are allotted if individual is Canadian and camera operation is done in Canada.

Estimate of Total Paid Ontario labour expenditure between January 1, 2005 And December 31, 2007

This is the total of the following amounts to the extent that they are reasonable in the circumstances and included in the cost to, or in the case of depreciable property the capital cost to, the corporation, or any other person or partnership, of the production:

(a) the salary or wages directly attributable to the production that are incurred by the corporation for the stages of production of the property, from the production commencement time to the end of the post-production stage, and paid by it in the taxation year or within 60 days after the end of the taxation year (other than amounts incurred in that preceding taxation year that were paid within 60 days after the end of that preceding taxation year),

(b) that portion of the remuneration (other than salary or wages and other than remuneration that relates to services rendered in the preceding taxation year and that was paid within 60 days after the end of that preceding taxation year) that is directly attributable to the production of property, that relates to services rendered to the corporation for the stages of production , from the production commencement time to the end of the post-production stage, and that is paid by it in the taxation year or within 60 days after the end of the taxation year.

Labour Deferrals

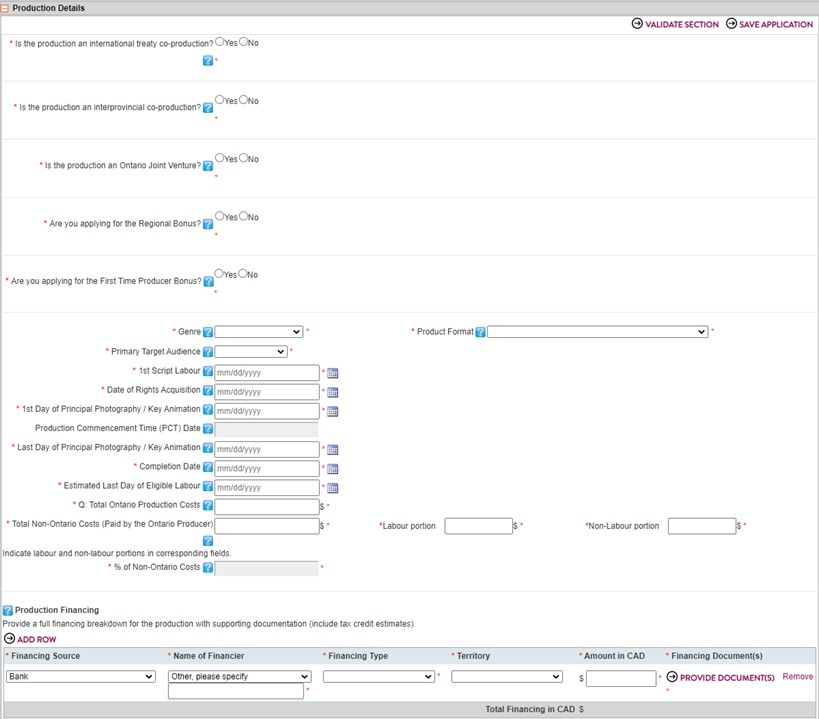

Filling the Production Details Section:

Definitions for the Production Details Section:

Is the production an international treaty co-production? -

Is the production an inter-provincial co-production?

�inter-provincial co-production� means a film or television production that is jointly produced in accordance with a co-production agreement between one or more qualifying production companies and one or more other corporations if,

(a) all of the other corporations are Canadians, and

(b) less than 75 percent of all amounts in respect of the cost to each of the other corporations of producing their portion or portions of the production, other than costs determined by reference to the amount of income from the production, are payable by the other corporations to Ontario-based individuals or corporations in respect of goods or services provided by the Ontario-based individuals or corporations in the course of carrying on business at a permanent establishment in Ontario. Please note that other provinces may have different criteria as to what constitutes an inter-provincial co-production.

Is the production an Ontario Joint Venture? - Between 2 or more Ontario companies.

Are you applying for Regional Bonus?

This refers to an eligible Ontario production,

(a) for which the principal photography in Ontario is done entirely outside the Greater Toronto Area, or

(b) for which the principal photography in Ontario is done in whole or in part outside a film studio, but only if,

(i) the number of Toronto location days for the production does not exceed 15 per cent of the total number of location days in respect of the production, and

(ii) the number of location days for the production is at least five or, in the case of a production that is a television series, is at least equal to the number of episodes in the production, or

(c) for which principal photography in Ontario consists entirely of animation, but only if no more than 15 per cent of the principal photography in Ontario is done in the GTA.

Are you applying for the 1st Time Producer Bonus?

A production is eligible for the bonus if,

(a) the production is an eligible Ontario production;

(b) the producer of the Ontario portion of the production has not more than one previous screen credit as a producer of a production commercially released, or broadcast on television during prime time, and has not participated as a producer of any other eligible Ontario production in respect of which a certificate has been issued under section 43.5 of the Act; and

(c) for the period starting immediately before the commencement of principal photography for the production and ending immediately after the date of issue of the last issued certificate for the production under subsection 43.5 (9) of the Act, the qualifying production company is not controlled directly or indirectly by,

(i) an individual with more than one previous screen credit as a producer of a production commercially released, or broadcast on television during prime time, or who has participated as a producer of any other eligible Ontario production in respect of which a certificate has been issued under section 43.5 of the Act, or

(ii) corporation that is, or is associated with, a qualifying production company to whom a certificate in respect of any other film or television production has been issued under section 43.5 of the Act.

1st Script Labour

That is the time at which a qualified corporation that has an interest in the production, or the parent of the corporation, first makes an expenditure for salary wages or other remuneration for activities, of scriptwriters, that are directly attributable to the development by the corporation of script material* of the production.

* �script material� of a production is written material describing the story on which the production is based and, for greater certainty, includes a draft script, original story, screen story, narration, television production concept, outline, or scene-by-scene schematic, synopsis or treatment

Date of Rights Acquisition

That is the time at which the corporation or the parent of the corporation acquires a property, on which the production is based, that is a published literary work, screenplay, play, personal history or all or part of the script material* of the production.

* �script material� of a production is written material describing the story on which the production is based and, for greater certainty, includes a draft script, original story, screen story, narration, television production concept, outline, or scene-by-scene schematic, synopsis or treatment

1st day of principal photography/key animation -

Production Commencement Time (PCT) Date:

Is the earlier of:

(a) Commencement of principal photography or

(b) The latest of:

I. 1st script labour expenditure,

II. date of rights acquisition or

III. 2 years before the commencement of principal photography.

Production Commencement Time (PCT) date is the earliest date from which labour expenditure may be calculated.

Last day of principal photography/key animation -

Estimated Last Day of Eligible Labour - The Online Applications Portal will use this date along with the Production Commencement Time to select the appropriate tax credit calculation form for this production.

Q: Total Ontario Production Costs - This is the Ontario Producer�s costs (both Ontario and non-Ontario expenditures).

Non-Ontario Costs (paid by the Ontario Producer) - That is the total of all funds payable from the production budget to non-Ontario residents and to facilities and suppliers located and providing services outside Ontario.

% of non-Ontario costs -

Production Financing - Include all sources and amounts used in the financing of the production, including provincial and federal tax credits. The total financing must be equal to or greater than the indicated Ontario Production costs. For interprovincial co-productions the total financing must be equal to or greater than the indicated Total Canadian costs.

Product Format -

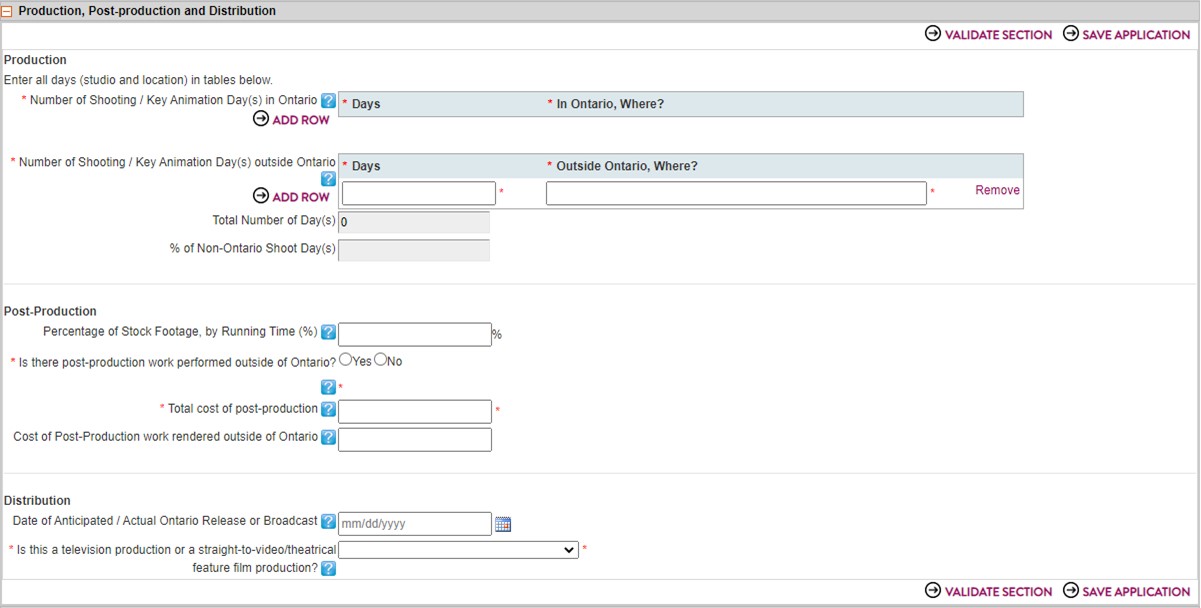

Filling out the Production, Post-production and Distribution section:

Definitions for the Production, Post-production and Distribution section:

Number of shooting /key animation day(s) in Ontario -

Number of shooting /key animation day(s) outside Ontario -

Percentage of stock footage, by running time (%) -

Cost of post-production work in Ontario -

Date of anticipated/actual Ontario release or broadcast -

Is this a television production or a straight-to-video/theatrical feature film production? -

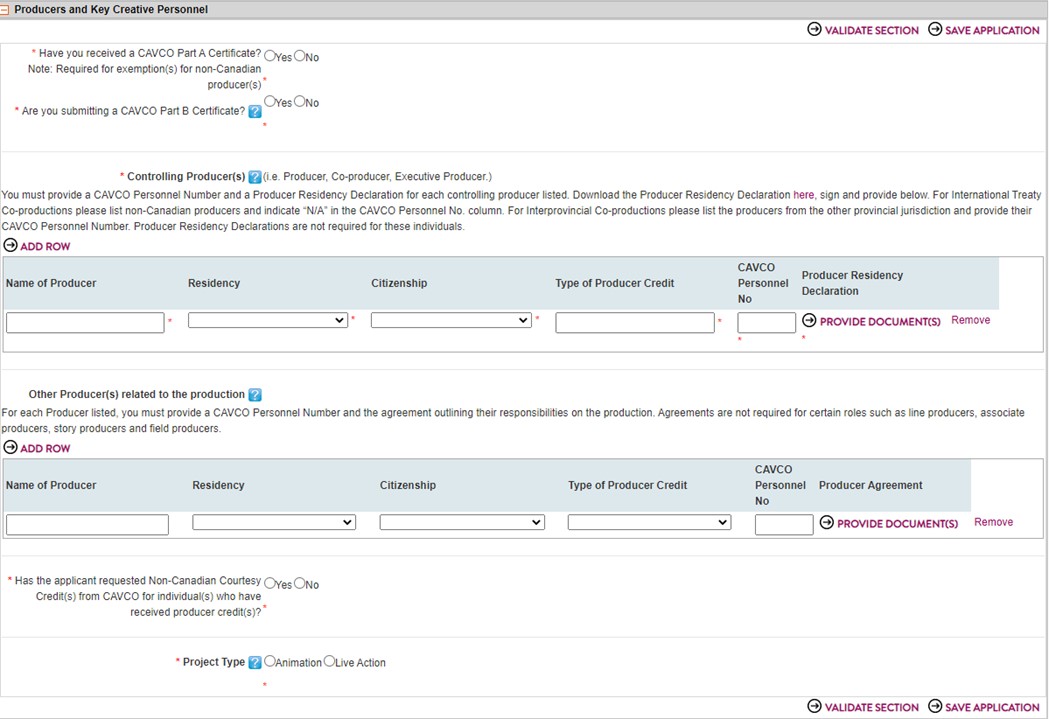

Filling out the Producers and Key creative personnel section:

Definitions for the Producers and Key Creative Personnel section:

Are you submitting a CAVCO part B certificate? -

Controlling Producer(s)

Controlling Producer is the individual(s):

(a) who controls and is the central decision maker in respect of the production,

(b) who is directly responsible for the acquisition of the production story or screenplay and the development, creative and financial control and exploitation of the production, and

(c) who is identified in the production as being the producer of the production;

Other Producer(s) related to the production - Please list all other producers not listed in the above field.

Project type -

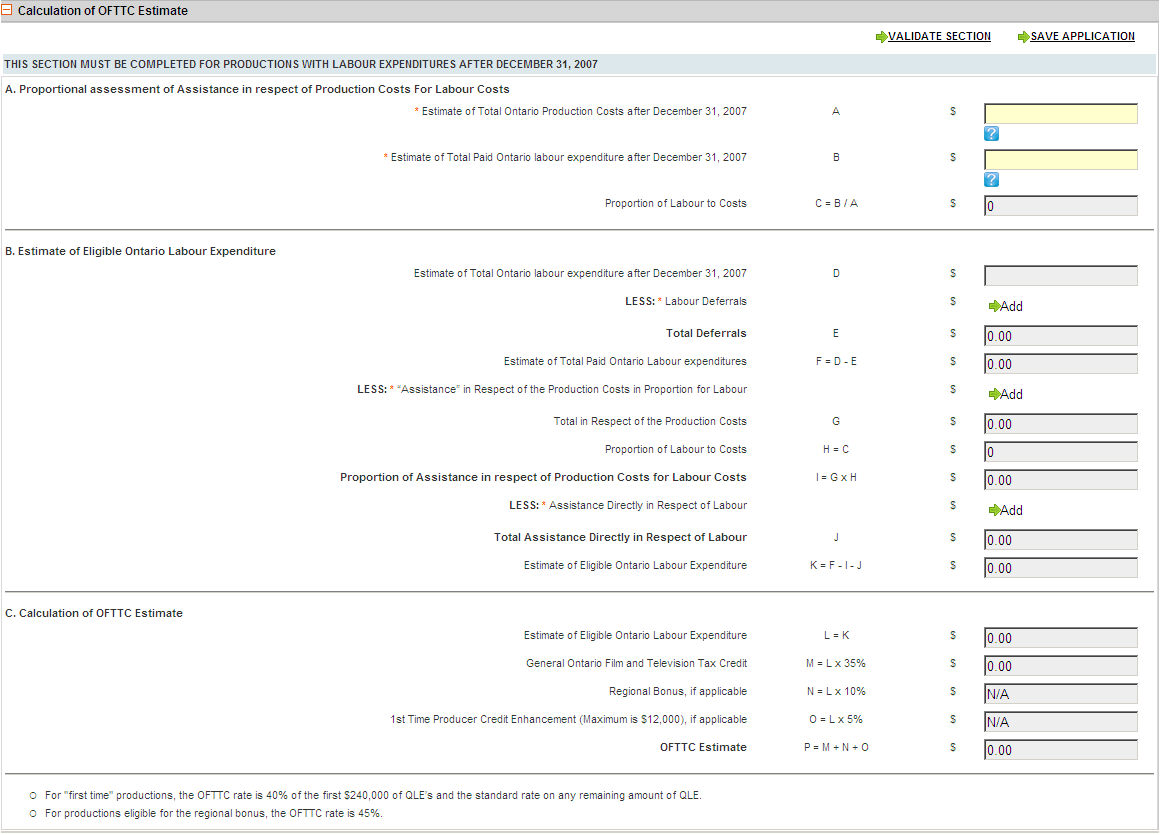

Filling out the Calculation of OFTTC Estimate:

Definitions for the Calculation of OFTTC Estimate:

Section A part A -

Section A part B -

Section B part D -

Section B part E -

Less: * �Assistance� in Respect of the Production Costs in Proportion for Labour - Assistance includes any grants or forgivable loans from a public or private source.

Less: *Assistance Directly in Respect of Labour - This refers to Assistance expressly directed to labour expenditures.

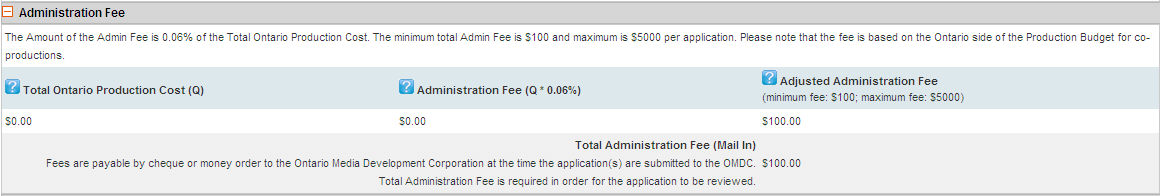

Definitions for the Administration Fee:

Total Ontario Production Cost (Q) - This is the Ontario Producer�s costs (both Ontario and non-Ontario expenditures).

Administration Fee (Q * 0.06%)- Calculated as 0.06% of the locked production budget, minimum of $100.00 and maximum of $5,000.00 per application. Applies to the Ontario side of the production budget in the case of co-productions.

Adjusted Administration Fee - The Administration Fee is non-refundable.

Please see Section 3 of Create Industry Development Program for detailed instructions.

Definitions for Supporting Documents:

Required Authorization Document: Applicant Declaration - Please note that we require a signed copy by an Authorized Signing Officer of the Corporation.

OMDC Waiver Declaration - The applications for both a Certificate of Eligibility and a Letter of Confirmation must be submitted to the OMDC no later than 24 months from the production company�s first taxation year end following the commencement of principal photography. If this application deadline cannot be met, it may be extended to 42 months from the first taxation year end date following commencement of principal photography, as long as the application is accompanied by a completed OMDC Waiver Declaration attesting that: (1) a Waiver in Respect of the Normal Reassessment Period (CRA Form T2029) has been filed with the Canada Revenue Agency (CRA) within the normal reassessment period for the first fiscal year end >>--> >>-->following commencement of principal photography (and second year, if applicable); or (2) the first fiscal year end following commencement of principal photography (and second year, if applicable); >>--> >>-->has not yet been assessed by the CRA.

Waiver in Respect of the Normal Reassessment Period (CRA Form T2029)

If applying for a Certificate of Eligibility and/or Letter of Confirmation after the 24-month deadline but before the 42-month deadline, the production company must file with the CRA a waiver, described in subparagraph 152(4)(a)(ii) of the Income Tax Act, within the normal reassessment period for the corporation (i.e. three years from the date of the Notice of Assessment; four years in the case of a public company) for the first (and second, if applicable) fiscal year end following commencement of principal photography. To obtain a Waiver in Respect of the Normal Reassessment Period (CRA Form T2029), visit the CRA Web site at at www.cra-arc.gc.ca

Certificate of Incorporation for the applicant production company - Please submit all pages of the Incorporation documents for the applicant, (if applicable) parent company and any shareholder corporations.

Corporate Chart

Note: indicating percentages of share holdings and nationality of shareholders for applicant company and all corporate owners, if applicable

Private Company Declaration (less than 50 shareholders) (CAVCO form)

Note: For applicant company and all corporate owners, if applicable:

If already on file with the OMDC Tax Credits, upload a new version only if there have been any changes

Completed CAVCO Application - Please submit a completed copy of the CAVCO A or B application whichever is most current.

Signed Producer Residency Declaration forms for ALL producers - This applies to the Ontario producers in an inter-provincial or treaty co-production. Such individuals include co-producers and executive producers and other producers who meet the definition noted above.

CAVCO exemption(s) for non-Canadian producer(s) (if required) - This is the CAVCO letter granting courtesy credits to non-Canadians usually issued simultaneously with the CAVCO A certificate.

Canadian citizenship declarations for ALL producer and producer related functions (Including production manager) and key creatives claimed for Canadian content points

CAVCO Part B certificate:

Chain of Title Documentation (including any legal opinion, writer agreements (for a series, a sample writer�s agreement, etc. ). -

Documents to support the applicant�s Production Commencement Time (PCT date)

� 1st Script Labour

� Date of rights acquisition

Documents must be directly related to the Applicant or its parent company and may include but is not limited to the following:

� Invoice for writing services

� Certificate of authorship

Episodic Canadian content point breakdown - This applies only for a series but not needed if the credit lists for each episode is submitted.

Production Schedule (including start and end dates of shooting days (if for a series, for each episode), and location of shooting) -

Cast and Crew Lists (with residency addresses) -

Locked production budget in Telefilm (or similar) format -

Schedule of Ontario labour costs: projected numbers based on the locked production budget if production is NOT complete.

Note: Producers should separate labour costs incurred up to and including December 31, 2007 and those incurred on and after January 1, 2008. - Please refer to our excel template on the OFTTC website.

Schedule of non-Ontario costs: projected numbers based on the locked production budget if production is NOT complete - Please refer to our excel template on the OFTTC website.

Signed final financing, equity, assistance, distribution, licensing, sales agency, exploitation and co-production agreements -

Guarantee from a Canadian broadcaster that the Production will be shown in Ontario between 7pm and 11pm within two years of completion (or proof that such broadcast has occurred)

Guarantee from an Ontario distributor that the Production will be released in Ontario within two years of completion (or proof that such distribution has occurred)

If this is not stipulated in the broadcast licence agreement please submit a letter from the broadcaster stating their intention to broadcast the production between 7pm and 11pm within two years of completion.

Children�s programming is not required to be broadcast between 7 and 11pm.

Telefilm Canada�s Preliminary Recommendation - This applies to international treaty co-productions.

Signed Co-Production Agreement - This applies to international treaty co-productions.

Signed Co-Production Agreement - This applies to inter-provincial co-productions.

Documents to indicate exact locations in Ontario for all shoot days and provide supporting documentation such as call sheets or daily production reports - Documents are necessary if you are applying as a regional Ontario production.

Copy of the Producer�s current Curriculum Vitae including credits for each producer on the production - CV should include all previous screen credits for productions that the individual has been associated.

1st Time Producer Declaration for each producer on the production -

DVD copy of the completed production that will be shown in Ontario -

Note: For television series, please submit the last episode or last available episode of the series.

Final Production Schedule - including start and end dates of shooting days (if for a series, for each episode), and location of shooting. Please include start and end dates for pre-production, principal photography, post production, and completion.

Final On-Camera Credit List - including start and end dates of shooting days (if for a series, for each episode), and location of shooting. Please include start and end dates for pre-production, principal photography, post production, and completion.

Final Location and % of Post Production that is Non-Ontario -Please confirm how much, if any, of the post production was completed outside Ontario.

Final Statement of production costs - as per CAVCO�s audit guidelines (Audited Statement of costs for productions with a final cost of $500,000 or more; or Review Engagement Report for productions with a final cost of $200,000 to $499,999).

Final Schedule of non-Ontario costs - Please submit final ACTUAL numbers based on the final Statement of Production costs

Final Cost Report - must be the detailed cost report upon which the audited statement of production costs was based

Telefilm Final Recommendation - for International Treaty Co-Productions only.

Once you have completed all sections of the Tax Credit Application , click the button to submit your application to OMDC.